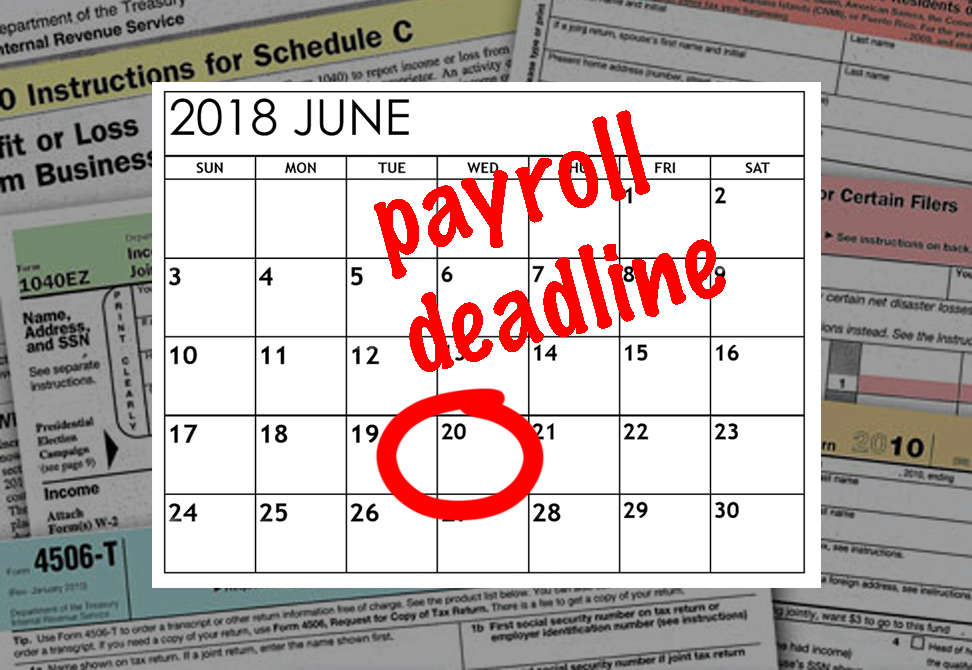

Please be advised that Wednesday, June 20 is the last day for 10- and 11-month employees to make changes to your summer payroll on July 15 and 31 and August 15 and 31 for any of the following deductions:

- Federal and state taxes

- Direct deposit accounts

- TSA 403B and 457 retirement contributions

- EAA union contribution withholding

- Credit union deductions

Changes to your summer mailing address should also be completed on Employee Self Service (ESS) or submitted to Human Resources by June 20.

The deadline of June 20 is only applicable to the pay periods of July and August. If you wish to make any of the above-mentioned changes for the 2018-19 school year, you may submit the changes to payroll at any time during the 2018-19 school year.

Changes made to your 403B and/or 457 contributions during July and August will be reflected in your first payroll for the 2018-2019 school year.

Questions? Contact the Payroll Office at payroll@acps.k12.va.us.